Consumers new to CBD look much like new consumers in many markets: low brand loyalty, sensitivity to price, and likely to try but not repeat. As High Yield details in the recent New CBD Consumer report, “Newbies” are bridging the gap between the attitudes of the general US adult consumer and the unique perspective of many CBD users. On the classic adoption curve, these new consumers fall somewhere close to the “early majority” – the innovators latched onto CBD years ago, and the early adopters followed, driving growth and product innovation. Now the Newbies are climbing aboard and casting about for a favored brand.

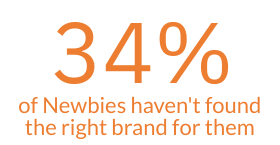

While searching for a product fit, these new consumers tend to hit a tipping point about six months in.

For consumers in the CBD category for seven months or longer, this figure drops to 24%, illustrating that with time, brand relationships strengthen. Thus brands are under pressure to find (or be easily found by) Newbies.

Asking For A Friend

In 2019, “online reviews” were identified as among the most trustworthy sources of information on CBD products by Newbies. “Cannabis dispensary or store associate” came in at the top with 43% reporting that option as the most trustworthy. Reviews and three others finished in a dead heat for the second-most common response at about 25%. Notably, “CBD company websites or social media pages” fell far down the list, near the bottom at 10%.

Flash-forward to today, particularly today’s retail environment, and the top two trusted sources of information for Newbies are:

- 38% user reviews (online or an app)

- 30% CBD brand website

In keeping with the theme of recent weeks, “Through trial and error” ranks in the top five for all of today’s consumer segments as a trusted “source” of information.

Asking consumers to take a flier on an unknown brand is a challenge. The ask will be that much harder for brands that struggle to make contact early. But brand loyalty is still low. Asked about the reasons behind the most recent purchase of Topicals, only 10% indicated “It was from a brand I trust.”

New, Not n00b

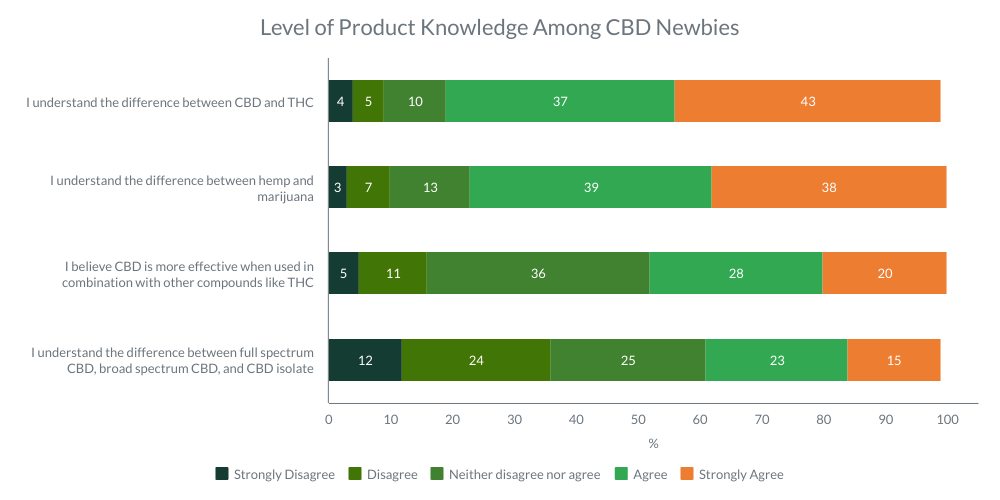

The findings from a past High Yield studies study show how different Newbies look now. Comparing to the results of High Yield’s January 2019 cannabis consumer survey, for instance, shows the impact of broader use, availability, and education. In the earlier study, only 27% of new CBD users reported understanding the differences between isolate, broad, and full-spectrum CBD.

Today, consumers new to CBD have more information and more accessible product. As a result, thirty-eight percent of today’s Newbies claim to understand those differences.

For reference, the figures represented in the charts and the data for the Newbies segment draw from High Yield’s Q4 2020 survey of US adults. The base of the study was 35,000+ US adults inclusive of 4,117 current CBD consumers. Of the latter, Newbies make up 969 or about 24%. Newbies are defined as current CBD consumers who have been using CBD for six months or less.

Like A Bridge

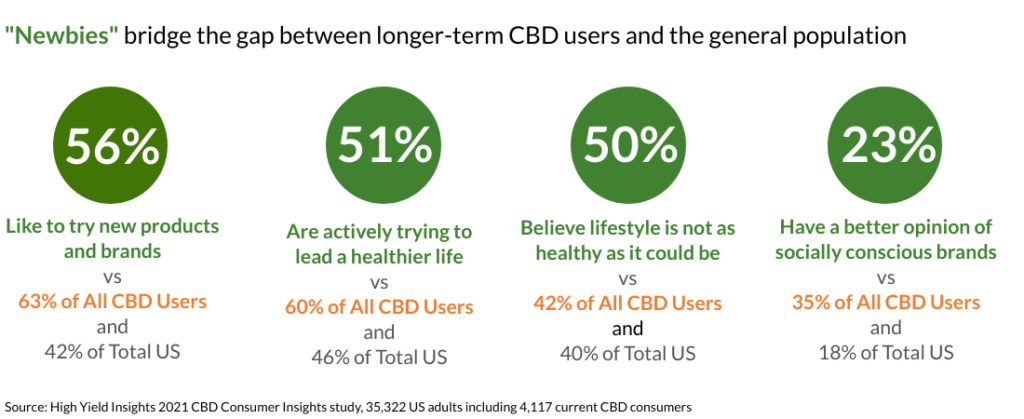

Newbies occupy an interesting segment of the CBD consumer base. Newbies seek out new brands and products well beyond the average US adult shopper but well below the typical CBD user. The trial-and-error dynamic somewhat demands an adventurous shopper in effect.

Pertaining to wellness, Newbies somewhat reflect the trend of CBD consumers as more intently seeking a healthier lifestyle. That Newbies have a dim view on personal wellness at present is likely evidence of one or both of two factors: first, some internal realization (Covid-19 stress isn’t going away) or second, an external issue such as injury or illness. Thus the Newbies’ purchase journey can be nudged by understanding which is behind the drive to try CBD and why.

Lastly, in what might be something of a surprise, Newbies are not attuned to socially conscious brands. In that sense, Newbies still look more like the general population than the typical CBD consumer. Brands seeking to align with Newbies can conserve precious bandwidth.

Innovations targeting Newbies can de-emphasize the brand’s position on social issues to prioritize a transparent and thorough communication on sourcing and efficacy. (54% of Newbies cite “clear wording on pack” as a critical packaging preference.) If integral to the brand’s DNA, lacking the social component altogether would be a mistake but that is a conversation to be had with customers during the journey, not at the outset.

The post CBD “Newbies” of Yesterday and Today appeared first on Cannabis Business Executive – Cannabis and Marijuana industry news.