PRESS RELEASE

VANCOUVER, BC, Feb. 4, 2021 /CNW/ – BGP Acquisition Corp. (“BGP“) is pleased to announce the closing of the initial public offering (the “Offering“) of 11,500,000 class A restricted voting units (“Class A Restricted Voting Units“) (including 1,500,000 Class A Restricted Voting Units issued pursuant to the exercise in full of the over-allotment option) at an offering price of U.S.$10.00 per Class A Restricted Voting Unit, for gross proceeds of U.S.$115,000,000. The proceeds from the distribution of the Class A Restricted Voting Units were deposited into an escrow account and will only be released upon certain prescribed conditions, as further described in the final prospectus dated January 28, 2021 (the “Final Prospectus“).

Echelon Wealth Partners Inc. acted as the sole underwriter (the “Underwriter“) in connection with the Offering. Imperial Capital, LLC acted as U.S. placement agent in connection with the Offering.

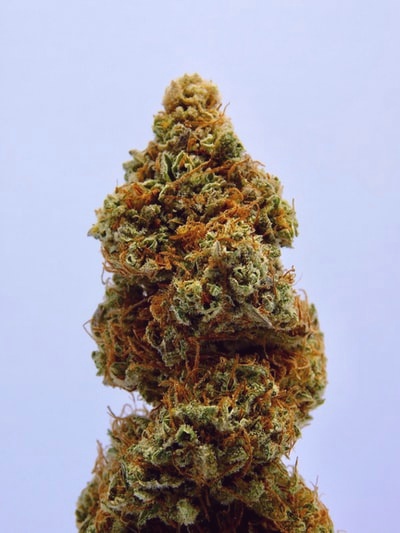

BGP is a special purpose acquisition corporation incorporated under the laws of the Province of British Columbia for the purpose of effecting, directly or indirectly, an acquisition of one or more businesses or assets, by way of a merger, amalgamation, arrangement, share exchange, asset acquisition, share purchase, reorganization, or any other similar business combination within a specified period of time (a “Qualifying Transaction“). BGP intends to identify, evaluate, and execute an attractive Qualifying Transaction by leveraging its network to find one or more suitable target businesses wherever possible. BGP intends to focus its search for target businesses that are involved in cannabis and/or related sectors; however, it is not limited to a particular industry or geographic region for purposes of completing its Qualifying Transaction. The acquisition target is expected to be an operating business with an enterprise value greater than U.S.$250 million.

Each Class A Restricted Voting Unit is comprised of a class A restricted voting share of BGP (“Class A Restricted Voting Share“) and one-half of a share purchase warrant of BGP (each whole warrant being referred to as a “Warrant“).

The Class A Restricted Voting Units will commence trading today on the Neo Exchange Inc. (the “Exchange“) under the symbol “BGP.UN“. The Class A Restricted Voting Shares and the Warrants comprising the Class A Restricted Voting Units will initially trade as a unit but it is anticipated that the Class A Restricted Voting Shares and the Warrants will begin trading separately in 40 days (or, if such date is not an Exchange trading day, the next Exchange trading day). Upon separation of the Class A Restricted Voting Units, the Class A Restricted Voting Shares and the Warrants will commence trading on the Exchange under the symbols “BGP.U” and “BGP.WT.U“, respectively. Prior to any Qualifying Transaction, the Class A Restricted Voting Shares may only be redeemed upon certain events. The Class A Restricted Voting Shares will be redeemable for a pro-rata portion of the amount then held in the escrow account, net of taxes payable and other prescribed amounts. It is anticipated that the Class B shares (“Class B Shares“) issued to the Sponsor (as defined below) will not be listed prior to the Qualifying Transaction, as described in the Final Prospectus.

The Warrants will become exercisable during the period commencing 65 days after completion of a Qualifying Transaction and ending five years thereafter subject to adjustment and subject to early expiry or redemption by BGP as further described in the Final Prospectus. Each Warrant is exercisable to purchase one Class A Restricted Voting Share (which, following the closing of the Qualifying Transaction, will become one subordinate voting share of BGP) at a price of U.S.$11.50 per share.

BGP’s management team and board of directors is comprised of: Ruth Epstein (Chief Executive Officer and Chair of the Board), Don Jennings (President, Chief Financial Officer, Corporate Secretary and Director), Brian Kabot (Director), Lisa Sergi Trager (Director), Erik Ott (Director) and Scott Riley (Director).

BGP Acquisition Sponsor LP, our sponsor (the “Sponsor“), beneficially owns or controls, an aggregate of (i) 3,375,000 Class B Shares (including 2,995,000 Founders’ Shares (as defined in the Final Prospectus) and including the 380,000 Class B Shares forming part of the 380,000 Class B units (“Class B Units“)), representing 22.54% of the issued and outstanding shares (assuming no Class A Restricted Voting Units are purchased by the Sponsor in the Offering), and (ii) an aggregate of 380,000 Class B Units, representing 100% of the issued and outstanding Class B Units. The Class B Shares were acquired by the Sponsor, which took place through private agreement and not through the facilities of any stock exchange or any other marketplace, for approximately U.S.$0.0083 per share (or U.S.$25,000 in total) and the Class B Units were acquired by the Sponsor for U.S.$10.00 per Class B Unit (or U.S.$3,800,000 in total).

The Sponsor’s position in BGP was acquired for investment purposes. The Sponsor is restricted from selling its Class B Shares and Class B Units (including the underlying securities, each consisting of one Class B share and one-half of a Warrant), as described in the Final Prospectus. The Sponsor may purchase and/or sell any Class A Restricted Voting Units, Class A Restricted Voting Shares, and/or Warrants from time to time, subject to applicable law. In connection with the Offering, and as sponsor to BGP, the Sponsor entered into certain material agreements, all as described in the Final Prospectus.

BGP’s head office is located at c/o 1055 West Georgia Street, Suite 1500, Royal Centre, Vancouver, BC, V6E 4N7, Canadaand BGP’s registered and records office is located at the same address.

McMillan LLP is acting as Canadian legal counsel to BGP and Duane Morris LLP is acting as U.S. legal counsel to BGP. Goodmans LLP is acting as legal counsel to the Underwriter.

This press release is not an offer of securities for sale in the United States, and the securities may not be offered or sold in the United States absent registration or an exemption from registration. The securities have not been and will not be registered under the United States Securities Act of 1933. Copies of the Final Prospectus are available on SEDAR at www.sedar.com.

About BGP Acquisition Corp.

BGP Acquisition Corp. is a special purpose acquisition corporation incorporated under the laws of the Province of British Columbia for the purpose of effecting, directly or indirectly, a Qualifying Transaction within a specified period of time.

Forward-Looking Statements

This press release may contain forward–looking information within the meaning of applicable securities legislation, which reflects the Sponsor’s and BGP’s current expectations regarding future events. Forward–looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Sponsor’s or BGP’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward–looking information. Such risks and uncertainties include, but are not limited to, the factors discussed under “Risk Factors” in the Final Prospectus of BGP dated January 28, 2021. Neither the Sponsor nor BGP undertake any obligation to update such forward–looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

SOURCE BGP Acquisition Corp.

For further information: BGP Acquisition Corp., Ruth Epstein, Chief Executive Officer, ree@bgpadvisors.com, 415-237-1747

The post BGP Acquisition Corp. Announces Completion of U.S. $115,000,000 Initial Public Offering Including the Full Exercise of the Over-Allotment Option appeared first on Cannabis Business Executive – Cannabis and Marijuana industry news.